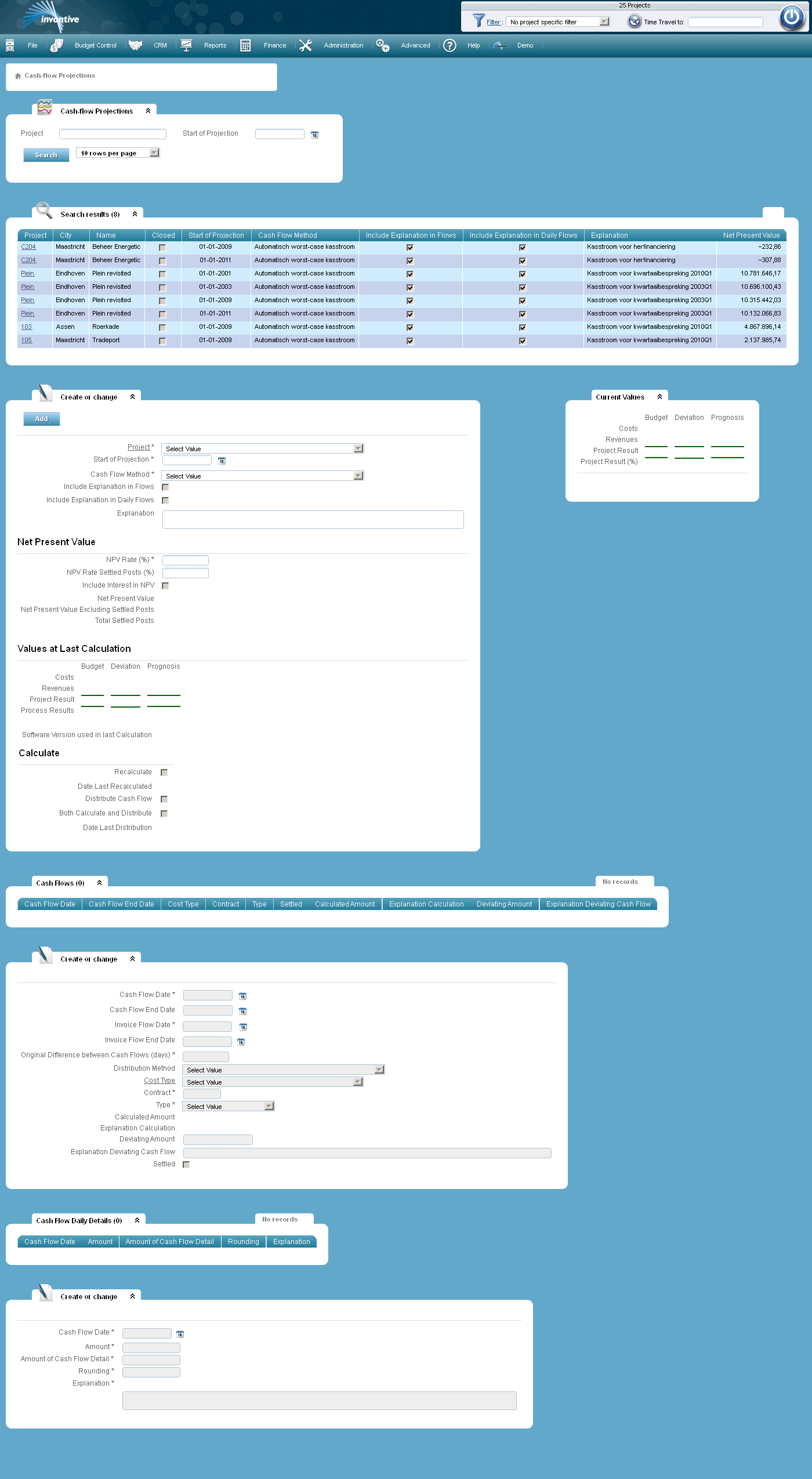

In this screen you can enter cash flow projections of a project per cost category. Open Form

Open Form

Using these projections you can calculate the present net value of the project on the basis of cash flow projections. The calculation is done in two steps:

1.Calculating: determines the size of each flow, start and end dates and distribution method.

2.Dividing: allocates the cash flow to the days of the calendar.

The two steps allow you to manually adjust the calculated cash flows if desired.

The meaning of the entry fields is:

Project |

The project which the latest estimate is part of. |

Start of Projection |

The starting date of the cash flow projection. |

Cash Flow Method |

The way cash flows are allocated to a period. |

Include Explanation in Flows |

When checked, the explanation will be included in the calculation of the cash flow. |

Include Explanation in Daily Flows |

When checked, the explanation will be included in the calculation of the daily cash flows. |

Explanation |

An informative explanation such as a reason why the 'Cash Flow Method' in question was chosen. |

Net Present Value |

|

NPV Rate (%) |

The percentage by which the present value (net value) of projected cash flows is calculated. |

NPV Rate Settled Posts (%) |

The percentage by which the present value of already paid/received amounts is calculated. |

Include interest in NPV |

The interest paid on loans is included in the NPV calculation if this option is checked. |

Calculate |

|

Recalculate |

The cash flow will be recalculated in the future when this option is checked. |

Distribute Cash Flow |

The cash flow will be allocated to the period starting with ‘Cash Flow Date’ and ends with ‘Cash Flow End Date’ if this option is checked. |

Both Calculate and Distribute |

The cash flow will be recalculated and distributed in the future if this option is checked. |

Cash Flows |

|

Cash Flow Date |

Shows the date the cash flow starts. |

Cash Flow End Date |

Displays the date when the cash flow ends. |

Invoice Flow Date |

Shows the date the invoice flow begins. |

Invoice Flow End Date |

Displays the date the invoice flow ends. |

Original Difference between Cash Flows (days) |

The initial difference in days between the invoice and the expected cash flow. |

Distribution Method |

The method by which the cash flow is distributed over the period. |

Cost Type |

The cost category on which is the cash flow is registered. |

Contract |

The contract ID to which the cash flow is related. |

Type |

Indicates what caused the cash flow. For example, this could be a contract, an invoice line, a budget, etc.. |

Deviating Amount |

Here you can enter a deviating amount. For the NPV calculation this amount will be included in stead of the ‘Calculated Amount’. |

Explanation Deviating Cash Flow |

A possible explanation of the deviating cash flow. |

Settled |

Indicates that the cash flow already took place in the form of a receipt and/or a payment if the box is checked. |

Cash Flow Daily Details |

|

Cash Flow Date |

Shows the date the cash flow starts. |

Amount |

The cash flow amount from which the daily cash flow is derived. |

Amount of Cash Flow Detail |

The amount of the cash flow details per day or per period. |

Rounding |

The amount that will be added to the daily cash flow to compensate for rounding errors. |

Explanation |

An informative explanation for the daily cash flow amount. |

The meaning of the other fields:

Project |

The project which the latest estimate is part of. |

Start of Projection |

The starting date of the cash flow projection. |

Net Present Value |

|

Net Present Value |

The net present value calculated using the shared cash flow and the interest on the cash flow including the already settled contracts. |

Net Present Value Excluding Settled Posts |

De netto huidige waarde berekend met behulp van de verdeelde kasstroom en de rente op de kasstromen, exclusief de al afgewikkelde contracten. |

Total Settled Posts |

Total amount of the up to now settled contracts. |

Values at Last Calculation |

|

Budget |

The project budget. |

Deviation |

The difference between the project budget and the project prognosis. |

Prognosis |

The project prognosis. |

Costs |

The costs of a project. |

Revenues |

The revenues of the project. |

Project Result |

The revenues minus the costs. |

Taken Result |

Amount at this moment is already booked as loss or profit. |

Software Version used in last Calculation |

The software version that was used for the final calculation of the cash flow amount or its distribution. If a new software version is installed it is possible that the equation with old cash flow amounts and its distributions is polluted. |

Calculate |

|

Date of last Recalculation |

Date when the last recalculation took place. |

Date Last Distribution |

Date when the last distribution took place. |

Cash Flows |

|

Calculated Amount |

The cash flow amount. |

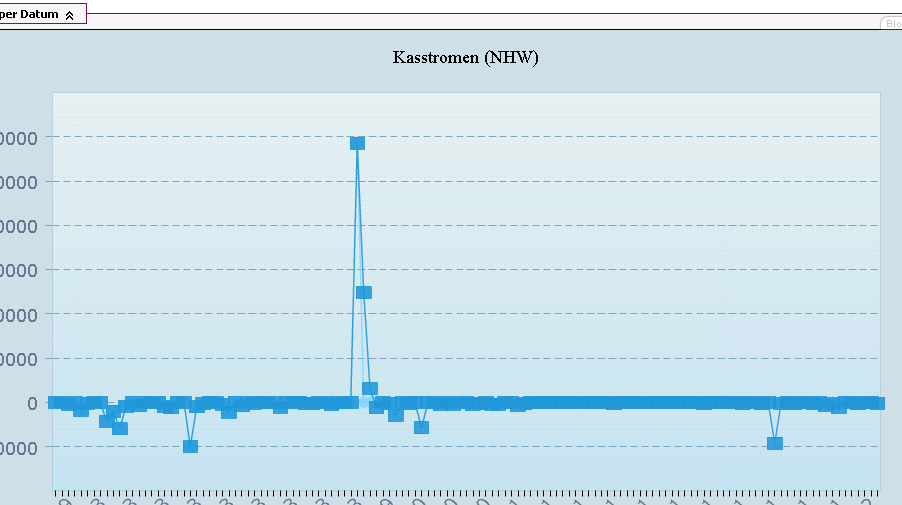

The cash flows per date provide an overview of the historical and projected cash flows:

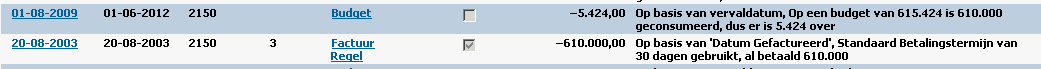

The cash flows are split into cash flow details. In the bottom part of the screen the cash flow details are shown. Each cash flow is supported with an explanation of the calculation:

In the example above a cost budget of EUR 615,424 was expected. Meanwhile EUR 610,000 is invoiced and paid. According to the expected maturity of the budget, the remaining budget of Eur 5,424 will be used between August 1, 2009 and June 1, 2012.

Invantive Estate

Invantive Estate