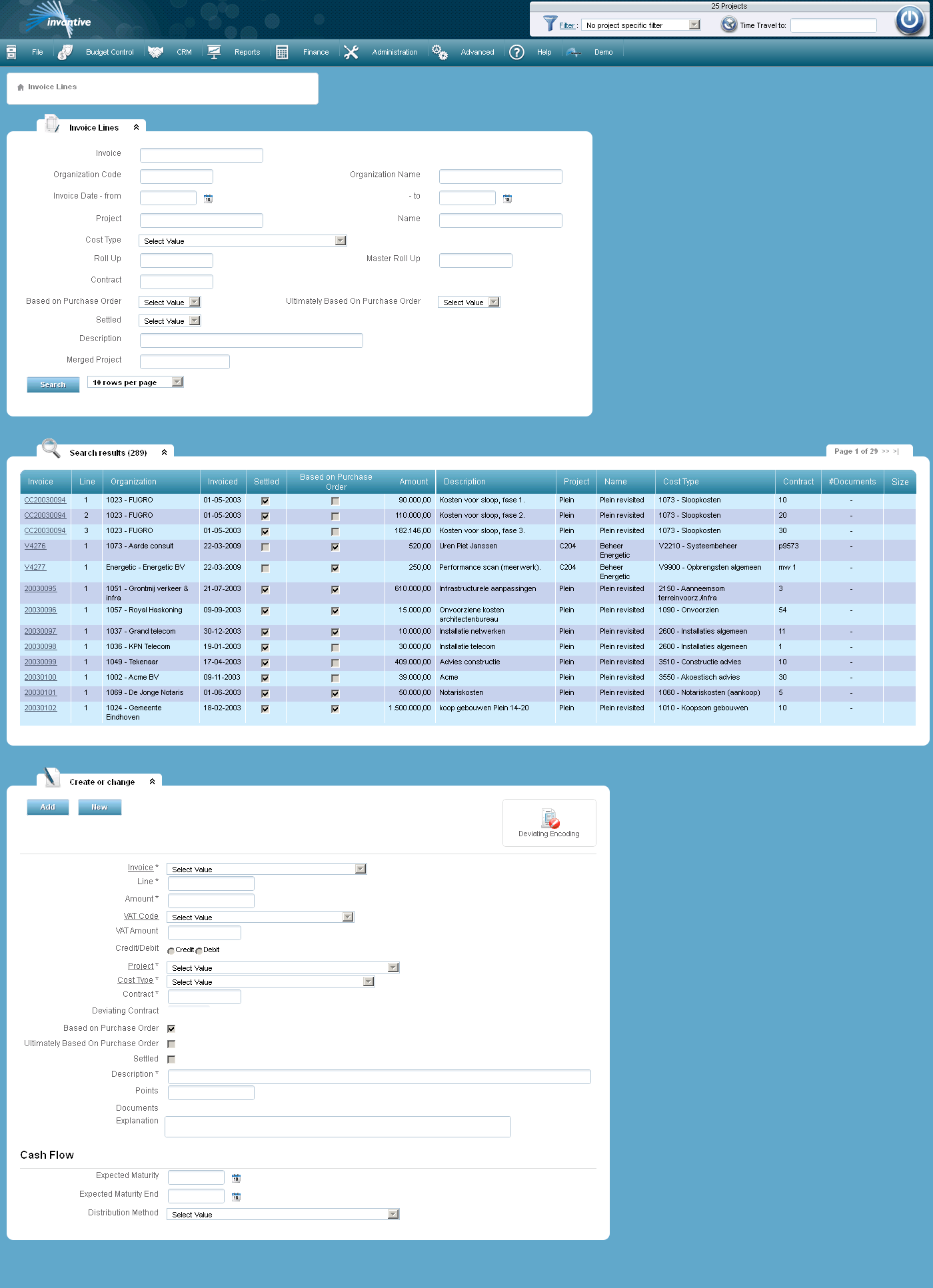

Invoice Lines |

In this screen you can register and modify Invoice lines. Open Form

Open Form

In the screen Invoices you can also see the invoice lines, but you cannot search them.

An invoice line reflects the realized revenue or the cost driver within a project. An invoice line can also display the profit taking of the project. It is possible that several invoice lines in one invoice refer to different projects.

Note that in general the invoices and invoice lines are not entered manually, but are automatically uploaded by the financial administration.

The meaning of the entry fields is:

Invoice |

The invoice code. In general the internally assigned invoice number will be used here. |

Line |

The line number within the invoice. |

Amount |

The amount invoiced. This normally will be the amount without VAT. If your organization is not subject to VAT, the amount of the balance has to be used (including VAT). |

VAT Code |

The VAT code that applies to the invoice. |

VAT Amount |

The VAT amount on the invoice. |

Credit/debit |

In case of a cost driver: does it concerns a regular entry (debit) or a credit entry? In case of a revenue: does it concerns a regular entry (credit) or debit entry? |

Project |

The project to which the realization refers. |

Cost Type |

The cost category to which the realization refers. All cost categories can be chosen (costs, revenues, and results). |

Contract |

The contract within the cost category to which the invoice line refers. |

Deviating Contract |

Here you can indicate the deviating contract if applicable. If the deviating contract is entered, it will override the standard contract in the reports. |

With Purchase Order |

In case of a cost driver: is the realization based on an order? In case of a revenue: is the realization based on a contractual sales agreement? |

Ultimately based on Purchase Order |

Ultimately based on purchase order is the result of originally based on purchase order and deviating with purchase order. |

Settled |

If the box is checked, the invoice line is made payable or received (revenue cost category). |

Description |

A description of the products, activity or situation to which the invoice relates to. |

Points |

Number of points awarded for this transaction. |

Documents |

Linked documents, see Linking Documents. |

Explanation |

Possible explanation. |

Expected Maturity |

The expected date when the cash flow starts. |

Expected Maturity End |

The expected date when the cash flow ends. |

Distribution Method |

The way the cash flow is distributed in time. |

Invantive Estate

Invantive Estate