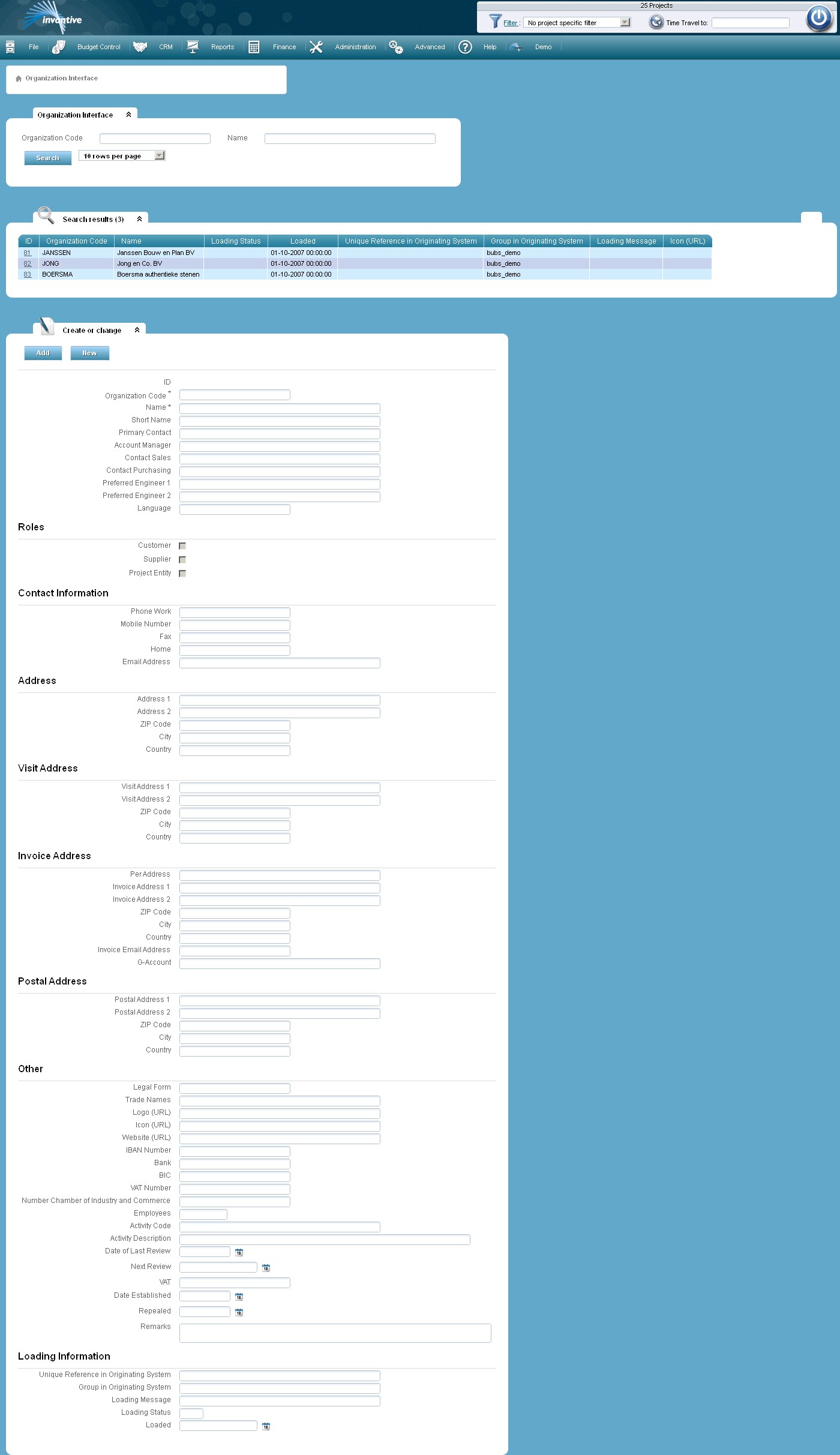

Through this screen, data can be exchanged with organizations on an ERP system. Open Form

Open Form

The meaning of the entry fields is:

Organization Code |

The code with which the organization is identified within the administration. |

Name |

The name of the organization. |

Short Name |

The abbreviated name of the organization. |

Primary contact |

The contact of the organization, appointed within the framework of the project. In many cases this will be the responsible account manager. |

Salesman |

The person responsible for the sales of the organization. |

Contact Sales |

The contact of the organization, appointed within the framework of sales. |

Contact Purchasing |

The contact of the organization, appointed within the framework of purchasing. |

Roles |

|

Customer |

The external or internal customer. For him the outcome of the project plays a role in the fulfillment of a mission or otherwise formulated objectives. The Project Manager is held responsible for its project by the external or internal customer. |

Supplier |

Can be used as a supplier when entering new orders in Orders or when entering new last estimates in Last Estimates. Do not check if the supplier is only used to relate realization figures based on invoice lines, for example, for artificial suppliers for results taken. |

Project entity |

The project is executed by an organization. This organization can be the same as the organization of the client. For most projects, this is not the case. The project manager also has to report within the organization which executes the project. The person to whom the project manager reports within its organization (the same as to the external customer) is the internal client. |

Contact Information |

|

Phone Work |

The telephone number where the contact of the organization can be reached at work. |

Mobile Number |

The mobile number of the contact of the organization. |

Fax |

The fax number of the organization. |

Home |

The telephone number where the contact of the organization can be reached at home. |

Email Address |

The email address of the contact. |

Address |

|

Address 1 |

The address of the organization. |

Address 2 |

An alternative address of the organization if the organization has several establishments. |

Zip Code |

The zip code. |

City |

The municipality where the organization is located. |

Country |

The country where the organization is located. |

Visit Address |

|

Visitor Address 1 |

Address for visitors. |

Visitor Address 2 |

Alternative Address for visitors. |

Zip Code |

The zip code. |

City |

The city of the visitor address. |

Country |

The country of the visitor address. |

Invoice Address |

|

Per Address |

Option to use a invoice address that does not belong to the organization. |

Invoice Address 1 |

Address that is used for invoicing. |

Invoice Address 2 |

Alternative address that can be used for invoicing. |

Zip Code |

The zip code. |

City |

The city of the invoice address. |

Country |

The country of the invoice address. |

G account |

The G account number of the organization. A G account is a blocked account that can be used by contractors to pay wage taxes (with or without VAT) of their employees to the tax authorities or to subcontractors. From a G account you cannot make other payments. The account protects parties against defaults of wage taxes. |

Postal Address |

|

Postal Address 1 |

Postal address of the organization. |

Postal Address 2 |

Alternative mailing address of the organization. |

Zip Code |

The zip code. |

City |

The city of the postal address. |

Country |

The country of the postal address. |

Other |

|

Legal Form |

A unique alphanumeric code for the legal form of the organization. |

Logo (URL) |

The Internet address where the logo can be requested. |

Icon (URL) |

The Internet address where the icon can be requested. |

Website (URL) |

The Internet address of the website if the organization has a website. |

IBAN Number |

The International Banc Account Number of the organization. The IBAN identifies an individual bank account and is used in cross border payments. |

VAT Number |

The VAT number of the organization that is intended to settle the VAT with the tax authorities. |

Number Chamber of Industry and Commerce |

The number with which the organization is registered at the Chamber of Commerce. |

Date Established |

The date of creation of the organization as a legal entity. |

Repealed |

The repeal date of the organization as a legal entity. |

Remarks |

Any additional information about the organization can be included in this field. |

Loading Information |

|

Unique Reference in Originating System |

Reference with which the record in the system of origin can be identified. |

Group in Originating System |

Reference to a group of records in the system of origin. The grouping of records is often used to validate the loading process using ‘application control’. |

Loading Message |

Displays a message on the most recent action of loading a record. |

Loading Status |

Displays status information about the loading process of the record. ‘E’ = ‘Error’ and ‘C’ = ‘Completed’. The completed load statuses will be automatically deleted at the end of the ERP processing. |

Loaded |

The point of time the record was loaded by the ERP interface. |

The meaning of the other fields:

ID |

The technical code with which the revenue can be identified. |

Invantive Estate

Invantive Estate